Zephyr Financial Services Software

Plan. Invest. Monitor. Grow.

Zephyr Named “Best Overall Analytics Platform” in 8th Annual FinTech Breakthrough Awards Program

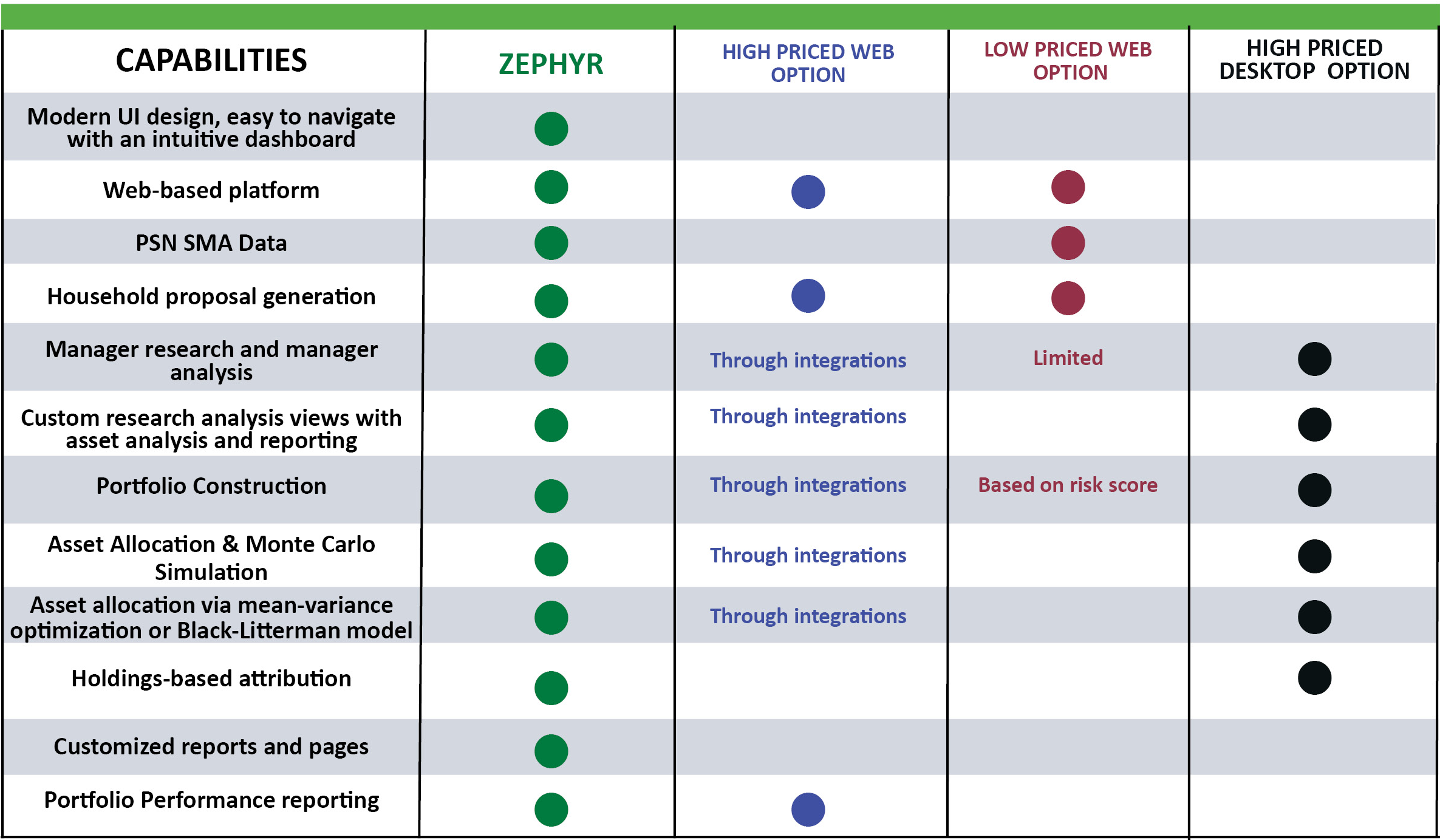

Zephyr Outperforms the Competition

As a portfolio management software, Zephyr is used for optimizing portfolios, identifying risk tolerance, evaluating portfolio performance, strategic asset allocation, proposal generation and trust management. Zephyr is also credited as an investor relationship management software because of its ability to create highly personalized proposals, custom reports and fact sheets.

Wealth Management Products and Services

Zephyr’s newly enhanced, award-winning technology perfectly positions investment professionals to succeed.

Custom Presentation and Reports

Create your own custom, personalized professional presentations choose a template from our extensive library

Risk Tolerance

Analyze the level of risk tolerance your client is comfortable assuming using our risk questionnaire or incorporate your own

Proposal Generation

Provide your clients with a comprehensive, easy to interpret proposal or compare current vs. suggested

Asset Allocation

Employ tactical asset allocation strategies that include assumption and analysis

PSN SMA Data

Financial SMA data and investment manager research to identify separately managed account opportunities

Manager Research

Screen thousands of investment portfolio products with powerful sorting, filtering and statistical tools

ESG Analysis

Research, screen, report and monitor Mutual Funds, ETFs, SMAs & Equities on numerous ESG metric ratings, scores, percentiles and rankings

Portfolio Performance

Quickly and efficiently evaluate portfolio performance, benchmark comparison at the Total Portfolio level, the Asset Class level, or a customized classification level

Investor Relationship Management Software

Generate More Referrals

Investors want to do more than just reach their financial goals; they want to exceed them. Successful investment results become legendary stories. Empower your client with outcomes that get shared.

- Generate easy-to-interpret proposals to showcase your ability and win clients

- Convey the value of your expertise by comparing your investment strategy or model portfolio to your prospect's current outlook

- Utilize portfolio proposal to draw comparisons

Calculate Client Risk

Guide your client by analyzing the risk tolerance to ensure optimal financial results.

- Identify your client's risk profile via our risk analysis questionnaire or integrate your own

- Employ sophisticated Asset Allocation modeling

- Utilize various risk measures to help mitigate client risk and maximize capital preservation

- Explain your portfolio performance and risk relative to standard or custom benchmarks

Customize Reports, Proposals and Fact Sheets

Investors need to be reassured, especially in a bear market. Hyper-personalization is crucial for financial services. Craft your story using our presentation center to drive new business and retain clients.

- Customize reports to meet a range of client needs from first-time investor to large institutional clients

- Create monthly, white-labeled fact sheets showcasing your brand's success

- Develop strong brand connections and build your brand equity via customization, image/logo and color

- Utilize our Batch Reporting functionality to automatically run reports and stay proactive with your clients